What does it mean for a social media platform to “die”?

Remember MySpace? Its…colourful…customisable profiles? Panic at the Disco tracks on auto-play? Some guy called Tom who just wanted to be everyone’s friend? NewsCorp famously snapped up the platform for $580 million in 2005, on a valuation of $12 billion; less than six years later, with a mass exodus to Facebook in full swing, they offloaded it for just $35 million.

And yet, MySpace is “still a thing.” The site is still up and running – just without the millions of active profiles it once boasted.

So MySpace is not dead?

Well, it re-launched in 2012 as a music and entertainment portal. Instead of being a social media network, you now access it through your social media logins, like Twitter. What better way to say “we lost the war”?

It’s now worth around 8% of its peak value. And as a social network, it’s worm food. If Twitter similarly re-brands as a lifestyle network before the end of the decade, I’ll be calling time of death as 2029.

The demographic problem

MySpace’s problem? It was generation-bound – its garish graphics and emo tracks sent grandma and aunt Karen running for the TV Times and crochet needles.

Then Facebook launched, with its famed exclusivity strategy (you initially needed to attend a prestigious university to join). When those barriers came down, its cool factor remained and brought with it the rest of the MySpace teens. Shortly after, its clean and simple design brought grandma and aunt Karen running for cat video heaven.

The result? Facebook is now also generation-bound – it’s just bound to an older generation than MySpace was. Its cool factor is long gone, with today’s teens instead choosing Snapchat and TikTok. While Facebook’s still growing, that growth is slowing – and it’s not coming from an influx of young new users.

Twitter’s problem is similar, except it’s way worse…

It’s home to no generation’s teens. Not now. Not ever. Instead, its worldwide user base skews male, old, and (fairly) rich. And nothing says “cool” like middle-aged, middle-class men…

Twitter largely missed out on the “cool” phase the other major networks enjoyed (or are enjoying). Fearful of a MySpace-esque mass exodus when Twitter launched, Facebook introduced “the feed,” which replicated the microblogging aspect of Twitter. That meant there was little need for many to choose Twitter instead of Facebook. What should have been Twitter’s cool phase came, went, and largely passed it by.

So while plenty of users signed up for Twitter – it had surpassed 50 million users by 2011 – Facebook retained its core user base and continued to grow. To social media users of 2006-2011, Facebook was still home. Twitter was more like the cabin in the woods.

Since then, Twitter has steadily climbed to 336 million accounts.

But there is a huge problem with that figure: only 134 million of those are active daily users. In fact, in 2014 CBS news reported that 44% of all Twitter users had never sent a single tweet. And it turned out that in 2018, Twitter had 75 million bots and fake accounts that had to be removed. That cabin in the woods seems like it’s fighting serious rot.

Compare that to Facebook’s 1.5 billion active daily users. Or Instagram’s 600 million. Or even Snapchat’s 186 million. And despite TikTok only launching in 2016, its 500 million active monthly users is far higher than the sum total of all Twitter accounts – active or otherwise.

Without new, young, active users joining, Twitter will last as long as it can keep its ageing audience’s attention. Twitter’s user growth slowed to zero a couple of years ago – and has not recovered since.

The financial problem

At some point, every startup has to leave its potential behind and start generating profit.

Facebook managed that in 2009, five years after it launched. Meanwhile, Twitter, took until 2018 to post its first annual profit. That’s nearly 12 years after its launch.

And while share prices aren’t necessarily a great indication of a startup’s future (hello, Wonga), that picture’s not a pretty one, either…

Twitter went public in 2013 with shares priced at $41, peaking at $69 in Jan 2014. From there, it was a steady slide to a low of $14 in 2016. That dip led to multiple rounds of layoffs (nearly one-in-ten Twitter employees lost their job in 2016), and to the ditching of Vine, which Twitter acquired for $30m.

While its share price is recovering (slowly), the fact is if you’d invested £1,000 in Twitter on its IPO day, your stake would now be worth just £902.

Compare that to Facebook. If you’d have invested your £1,000 on its IPO day in 2012, your stake would now be worth £5,579.

Yes, Twitter is finally turning a profit. And yes, profits are increasing. But that’s come largely from more profitable ad revenue models and its switch to reporting “average monetizable daily active users” instead of active users. That’s Twitter’s own metric that measures the number of users it can sell ads to in a day. And the switch will have everything to do with Twitter ending 2019 with six million fewer active accounts than it started that year with.

That’s the larger problem for Twitter – it’s both failing to attract new users and failing to hold on to its existing ones. That 2019 decline in active users wasn’t a fluke – in fact, the number of people abandoning their Twitter accounts has outstripped the number of new sign-ups for the past two years.

While Facebook has a similar problem (younger generations prefer TikTok, Instagram, and Snapchat), they’ve acquired new users by buying Instagram and WhatsApp. By contrast, Twitter’s Vine acquisition failed spectacularly, and picking up Periscope brought with it just 10 million users.

But does that really mean Twitter will die? In my (admittedly biased) opinion, there is one question that trumps all others:

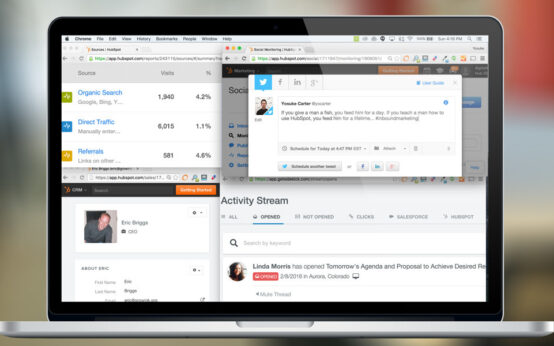

As a digital marketer, would I recommend clients run Twitter Ads, or make Twitter a core social channel?

To which the answer is a resounding “absolutely not.” At least as it stands.

I have run test campaigns on Twitter’s ad platform, and the return-on-investment was always variously outstripped by Facebook, LinkedIn, Instagram, Google, and Bing. No matter what the client’s objectives were, there was always a number of ad platforms better suited to the job than Twitter. Regardless of Twitter’s new focus on better ad models and reporting, there’s a lingering bad taste in the mouth from past experiments.

And if I wouldn’t recommend using Twitter ads, many other digital marketers wouldn’t, either.

For businesses with an existing Twitter presence, there is still value in posting organically. But for businesses with no current Twitter presence, it would be hard to justify the time investment to get them up and running. As with advertising ROI, engagement rates and follower growth are almost always stronger on other platforms – and therefore, so is return on time investment.

But the real issue for Twitter is revenue and profit. Google doesn’t make money from providing search results – they make it from ads. Facebook doesn’t make money from aunt Karen’s cat videos – they make it from ads. Twitter doesn’t make money from Katy Perry’s scintillating tweets – they make it from ads.

While Twitter’s now discovered how to sell ads in a profitable way, failing to attract new followers could put them close to peak profitability – unless they innovate. Because you can’t sell products to people who never log in. Or people who’ve deleted their account. Or 75 million bots. As long as Twitter ads continue to make less financial sense than the other networks, it will need to find new revenue streams to survive as a viable social network.

So back to the original statement…

“Twitter will die this decade”

Twelve years is a long time to turn your first profit. Especially when you’re bleeding active users. Especially when you’re not attracting new ones. Especially when there’s no apparent strategy to fix that. Especially when it’s cost you 9% of your workforce.

You heard it here first. RIP Twitter – time of death, 2029 or sooner.

10 amazing content marketing examples

10 amazing content marketing examples  Inbound content marketing – what is it and how does it work?

Inbound content marketing – what is it and how does it work?  The problem with defining “content strategy”

The problem with defining “content strategy”  How effective is content marketing?

How effective is content marketing?  Is AI a content marketer’s friend or foe?

Is AI a content marketer’s friend or foe?  What is attraction content marketing?

What is attraction content marketing?